Walee Financial Services App “Hakeem” awarded by Monetary Authority of Singapore : A major milestone for Islamic finance & Pakistan.

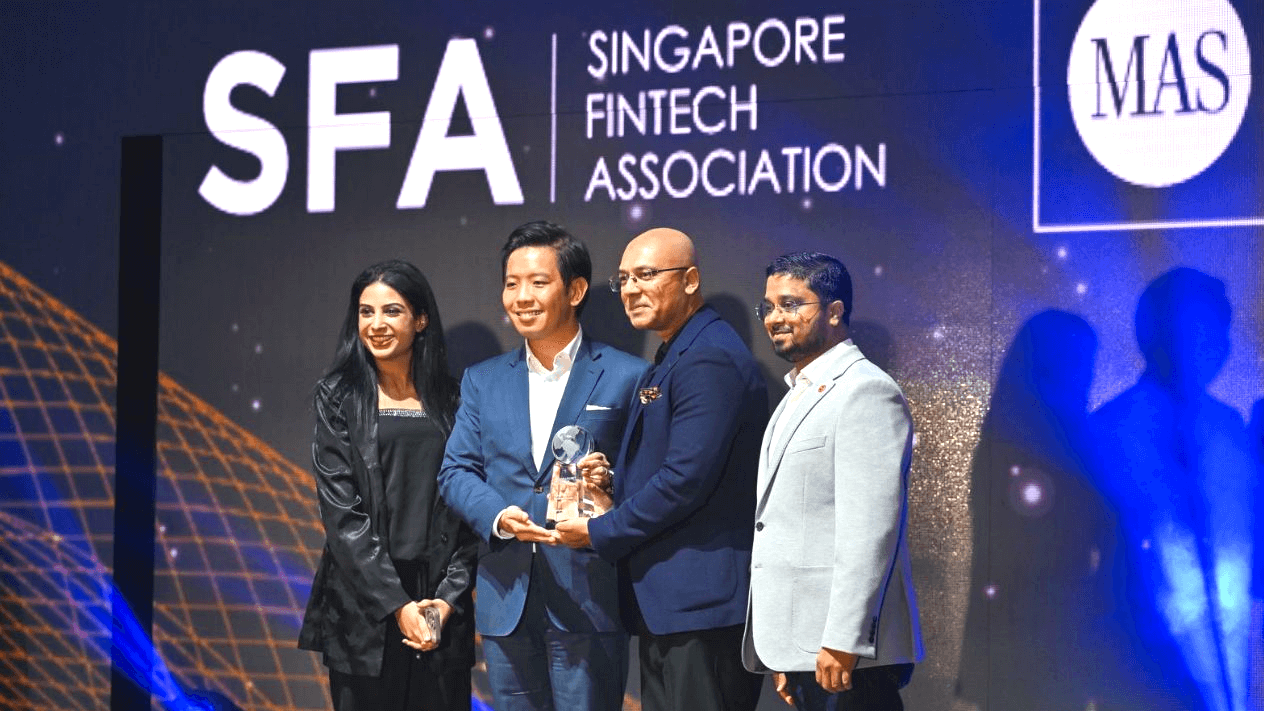

In a proud moment for Walee Financial Services and the broader Islamic finance ecosystem, our pioneering Islamic digital financing product, Hakeem, has received top honors at the 10th-anniversary Singapore FinTech Festival (SFF) Awards. This prestigious recognition, awarded by the Monetary Authority of Singapore (MAS) in collaboration with PwC and the Singapore FinTech Authority, underscores not only the growth and promise of Islamic digital finance but also places Pakistan on the global map for financial technology and innovation.

With over 200 submissions this year, MAS winners & criteria only eight winners were selected across six award categories by a distinguished panel of global industry experts. Walee Financial Services was recognized among an elite group of winners, including Tencent, one of the world’s largest and most influential FinTech companies. In a memorable moment, Walee was the first company called to the stage to receive this award, highlighting the early success of our Hakeem app. This award is more than an accolade; it is a testament to our relentless dedication to innovation, the power of Islamic finance, and the enduring impact of inclusive, shariah-compliant solutions.

- A Win for Islamic Finance Islamic finance, projected to be a $7 trillion industry by 2027, is a rapidly expanding field that aligns finance with ethical principles, providing shariah-compliant alternatives to traditional financial products. Hakeem, our digital Islamic financing app, was designed to meet the needs of underserved communities and those still financially excluded, offering ethical, accessible financing on a digital platform.

- A Breakthrough for Pakistan’s FinTech Sector This recognition also shines a spotlight on Pakistan’s thriving tech and innovation sectors. Pakistan’s inclusion in this global recognition highlights the country’s evolving capacity for innovation and its commitment to excellence. As the country attracts attention from foreign direct investment (FDI) and banking partnerships, it holds great promise for opening doors to global banking collaborations and funding opportunities that will fuel FinTech growth.

- The Unique Team Behind Hakeem The success of Hakeem is a result of the unique blend of experience and innovation that defines our team at Walee Financial Services. We are proud to have a core team of seasoned Islamic bankers who were instrumental in establishing banks like Emaan Islamic Bank and Dubai Islamic Bank from the ground up. Their expertise in Islamic banking is complemented by the knowledge of our data scientists, developers, and tech specialists. Together, we combined deep-rooted Islamic finance principles with cutting-edge technology to create Hakeem, a solution designed to empower underserved communities with access to ethical financing.

- The Journey and Vision Behind Hakeem Launching a successful, shariah-compliant digital financing solution has been no easy feat, requiring years of hard work, innovation, and a tireless commitment to building an ethical financial system. The name Hakeem, meaning “wise,” was chosen by our mentor, Mr. Rehan Merchant, who has been instrumental in shaping our journey. The name resonates with our goal of empowering users to make wise financial decisions while providing a service that aligns with the shariah. In this way, Hakeem offers much more than a product—it is a financial tool designed to uplift communities, SMEs, and individuals while reflecting one of the noble attributes of Allah (Al Hakeem).

Our journey with Hakeem included the implementation of an unorganized tawarruq model under a classical framework based on the murabaha principle. This innovative approach simplifies access to finance for underserved communities, MSMEs, and consumers. Hakeem offers easy access to funding through a transparent, shariah-compliant model that makes the dream of financial inclusion for all a reality.

Thanks to the support of our shariah advisors, global mentors in Islamic finance, and technology innovations in artificial intelligence and machine learning, this framework has come to life in 2024. This groundbreaking milestone is a testament to the combined efforts of our shariah, tech, operations, finance, customer service, compliance, and business teams who shared this vision.

Acknowledgments to Industry Enablers and Supporters By 2028 Islamic Finance is a must in Pakistan

This achievement could not have been realized without the collaboration of regulators, notably the SECP, who stood firmly against predatory lending practices, enabling ethical, innovative solutions like Hakeem to flourish under clear shariah guidelines. The State Bank of Pakistan and the Ministry of Finance have also played essential roles in creating an ecosystem where Islamic finance can thrive, furthered by the recent 26th constitutional amendment bill to eliminate riba (interest) by 2028. This measure is expected to foster the growth of Islamic banking in Pakistan, creating a positive environment for financial inclusion.

A Personal Reflection: The Evolution of Islamic Finance and the Path Forward Reflecting on the early days of Meezan Bank, Dubai Islamic Bank, Faisal Bank, and Bank Alfalah, I remember the initial challenges and immense innovation that drove these institutions to launch pioneering Islamic financial products. Despite the difficulties of those early years, Islamic banking now leads in customer satisfaction, profitability, and business growth. Today, history is repeating itself with a modern twist. This time, with the integration of advanced technology and the collective experience we’ve built, the journey of Islamic finance is unfolding faster, more efficiently, and with even greater promise. Together, we’re shaping a new era in “Islamic FinTech” to solve real problems on the ground, bringing inclusive, shariah-compliant finance to those who need it most.

GFTN Role: A New Era for Global FinTech Innovation

As we celebrate this win, we look forward to new avenues of collaboration, particularly with GFTN. Previously known as Elevandi has now evolved with four strategic arms:

- GFTN Forums: A global conference convenor dedicated to finance and technology.

- GFTN Advisory: A knowledge center offering practitioner-led advisory services and research on innovation policies and ecosystems.

- GFTN Platforms: A digital platform service provider for businesses, especially small and medium enterprises.

- GFTN Capital: An investment fund for technology start-ups with high potential for sustained growth and positive social impact.

GFTN Capital will look to invest in disruptors likes of Walee Financial Services, leading in Islamic FinTech innovations.

With gratitude and optimism,

Noshad Minhas CEO, Walee Financial Services

MAS and SFA Announce FinTech Award Winners at Singapore FinTech Festival 2024

Global FinTech Hackcelerator

2. The Global FinTech Hackcelerator, organised by MAS in partnership with the Global Finance & Technology Network (GFTN)[1], sought innovative and market-ready solutions, to address problem statements centred on “Improving Financial Health”. The winners of the competition were selected on Demo Day, held on 6 November 2024 during SFF. The 18 finalists pitched their solutions to a panel comprising industry experts across multiple domains (further details on the competition and the judging panel can be found at Annex A).

3. The top three teams (in alphabetical order and in no order of merit) that will receive S$50,000 each in prize money are:

| Company Name | Solution Name | Country |

| KaiOS Enable Tomorrow | KaiOS | China |

| WeGro | WeGro | Bangladesh |

| Your Financial Wellness | Your Financial Wellness | Australia |

4. KaiOS aims to transform financial literacy with a gamified, interactive approach that is accessible to everyone – even those without mobile phones. With their personalised learning experience on feature phones, KaiOS ensures users gain practical and enduring financial skills. KaiOS’s ‘learn-to-earn’ model provides real incentives to embark on a digital journey, step by step. Users convert the points they earn into coins with monetary value, which can then be used for savings and other financial services. Recognising that many individuals still rely on cash, the platform utilises existing cash-digital bridges like airtime and mobile money agents.

5. WeGro is a pioneering Agri-FinTech platform that leverages Open Banking and peer-to-peer (P2P) lending to offer tailored financial products, including loans, savings accounts and agricultural insurance, specifically designed for smallholder farmers. The platform integrates all aspects of the farmer’s financial journey, including onboarding, KYC verification, loan origination, product purchasing and repayment within a single digital marketplace. Additionally, WeGro facilitates P2P lending, enabling individuals and investors to directly fund farmers, aligning their interests, and fostering community-driven financial support.

6. Your Financial Wellness (YFW) offers a scalable, personalised platform designed to tackle the global challenges of financial literacy and wellness. The platform is a turn-key solution made available through financial institutions and employers and helps users articulate and achieve their financial goals and aspirations. By leveraging advanced data analytics and algorithm-driven personalisation, YFW delivers content that is uniquely relevant to each user’s financial situation, ensuring greater engagement, improved financial literacy and better decision-making.

SFF FinTech Excellence Awards

7. The Awards, jointly organised with SFA and supported by PwC Singapore, recognises innovative FinTech solutions by corporates and individuals. These solutions seek to harness new technologies, create new growth opportunities, promote financial inclusion, and enhance the delivery of financial services.

8. Over 200 submissions were received this year, and eight winners across six award categories were eventually selected by an international panel of industry experts across multiple domains (more details on the competition and the judging panel are in Annex B).

9. The winners for the Corporate categories for the SFF FinTech Excellence Awards 2024 are[2]:

| Award Category (Corporates) | Company Name |

| Emerging FinTech Award | Walee Financial Services |

| Financial Inclusivity Award | PolicyStreet |

| Regulatory Leader Award | Napier AI |

| Sustainable Innovator Award | Rizal Commercial Banking Corporation |

| Thematic–Artificial Intelligence, Quantum Champion | Tencent |

| Award Category (Individual) | Individual Name | Company Name & Position |

| FinTech Mentor Award | Andrea Baronchelli | Aspire, CEO and Co-founder |

| Dr Dorian Selz | Squirro AG, CEO and Co-founder | |

| Frans Wiwanto | Flywire (Singapore), CEO – APAC |

11. Mr Sopnendu Mohanty, Chief FinTech Officer, MAS and Group Chief Executive Officer (designate), GFTN, said, “Once again, the Global FinTech Hackcelerator and FinTech Excellence Awards highlight the immense potential within the FinTech sector, showcasing exceptional innovations that address pressing challenges in the financial industry. We are proud to see this platform continue to foster impactful solutions that bring meaningful benefits to the financial industry and communities it serves. Our heartiest congratulations to all our winners!”

12. Mr Shadab Taiyabi, President of SFA, said, “I want to extend my deepest congratulations to the winners of the Global FinTech Hackcelerator and the SFF FinTech Excellence Awards. As Singapore strives to be a global FinTech leader, the solutions developed by FinTechs today will play a crucial role in addressing real-world challenges and driving future growth across various sectors. We look forward to seeing how these advancements will continue to shape the future of Singapore’s FinTech landscape.”